Registrations are now open for the entrance exam for Hospitality Management, Culinary Arts, Design, and Business Administration on 19th April 2025. Register Now!

Home » Becoming a Game Designer: How Indian Students Can Drive the Global Gaming Future

Games have always been an integral part of Indian life and culture. From ancient times, our civilisation has learned through play and grown with it. India has given the world iconic outdoor games like kho-kho and kabaddi, and indoor games like chess and snakes and ladders-originally known to us as chaturanga and gyan chauper.

Over the years, we have not only embraced games introduced from outside-like cricket and badminton-but also made them our own. Across villages and cities alike, games in India have traditionally been collective experiences, built on values of respect, responsibility, and community. Players are taught to honour the rules, care for their teammates and opponents, and accept the umpire’s decisions with grace.

It’s with this same spirit that we must now approach the digital gaming world-infusing it with our values and transforming it into a powerful pillar of Viksit Bharat. Gaming has the potential to carry Indian stories, history, and culture across borders, while also echoing our ancient wisdom and the philosophy of Vasudhaiva Kutumbakam-the world is one family.

During the 78th Independence Day celebrations, Prime Minister Narendra Modi emphasized the importance of creating games that are not only made in India but also reflect its cultural stories and values. He called upon theindustry to lead the global market by building games that resonate with India’s heritage and voice (Invest India, 2024).

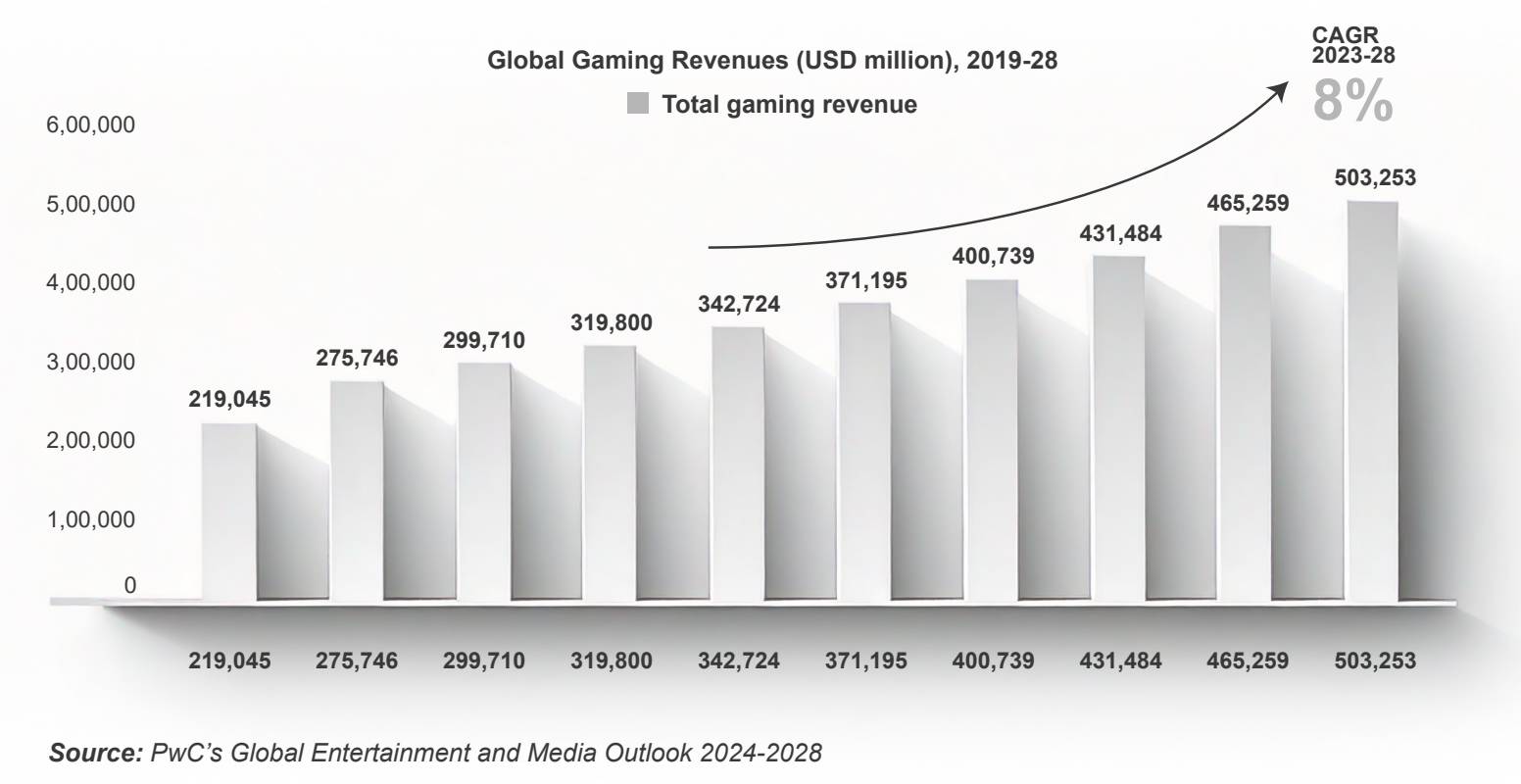

India’s gaming industry is going through a moment of transformation. A young, tech-savvy population, affordable smartphones, and low-cost mobile data have all helped fuel this shift. With over 650 million mobile users, digital gaming is no longer just a form of entertainment-it’s an emerging economic force. Globally, gaming revenues have grown from USD 219 billion in 2019 to USD 342 billion by 2023. By 2028, this figure is expected to cross USD 500 billion, with the Asia-Pacific region contributing more than half of that growth (Invest India, 2024).

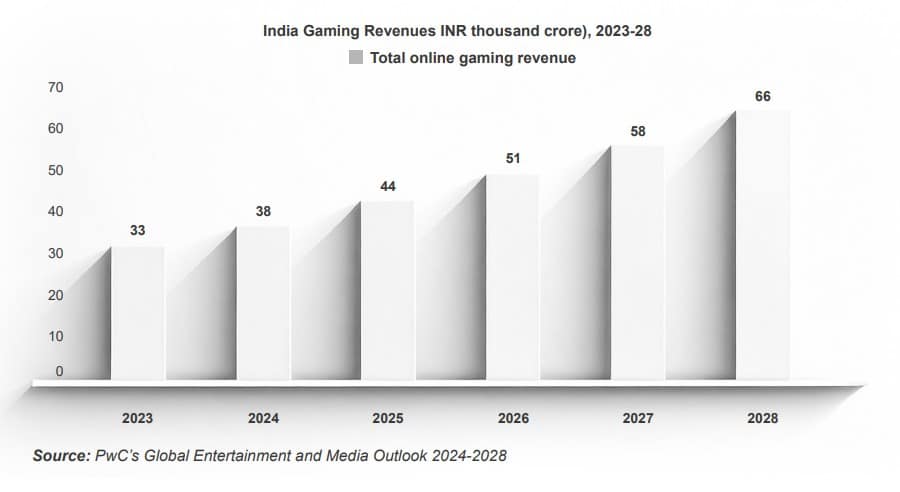

Back home, India’s online gaming market-valued at INR 33,000 crore in 2023-is expected to double by 2028, reaching INR 66,000 crore. A significant part of this growth comes from the real money gaming segment, which generated INR 16,500 crore last year. Projections suggest that this boom will create between two to three lakh direct and indirect job opportunities (Invest India, 2024).

Skill-based gaming continues to lead the real money space, while casual and social gaming is catching on fast, especially among working professionals and college youth. With an estimated CAGR of over 21%, casual gaming is set to capture an even larger share of the market. The confidence of international investors is already visible: nearly USD 2.8 billion (around INR 23,000 crore) has been invested in Indian gaming startups in the last five years alone. This capital injection is helping new ideas flourish and pushing India closer to becoming a global name in the gaming world (Invest India, 2024).

The global gaming revenues grew from USD 219 billion in 2019 to USD 342 billion in 2023 and are estimated to grow at a compounded annual growth rate (CAGR) of 8% to exceed USD 503 billion by the end of 2028

The sharp increase in gaming revenues between 2019 and 2022 was largely fueled by the global shift toward digital entertainment during the COVID-19 pandemic. As people across the world faced extended lockdowns, online gaming emerged as a primary source of both entertainment and social interaction. This led to a rapid expansion in user engagement that continued even after restrictions were lifted.

By 2023, however, the industry began experiencing a phase of market correction and consolidation. Companies began reassessing growth strategies, resulting in budget cuts, reduced investments, sponsor pullbacks, and workforce downsizing. It is estimated that around 10,000 jobs were lost during this transitional period. This downturn was driven in part by a need to streamline operations after over-hiring during the pandemic boom. Moreover, gaming firms began focusing on generating greater returns from existing intellectual properties rather than continuing their earlier spree of content creation and acquisitions (PwC, 2024).

India’s online gaming market-an integral part of the broader AVGC-XR (Animation, VFX, Gaming, Comics, and Extended Reality) sector-has experienced significant growth in the last five years. The industry’s future is being reshaped by how games are created, distributed, monetized, and experienced. Key technologies like spatial computing (AR/VR), blockchain, and AI are driving this transformation, enabling greater immersion, personalized gameplay, and secure transactions in an increasingly competitive landscape (Ministry of Information and Broadcasting, 2022).

Back in 2019, India’s AVGC sector was valued at INR 19,150 crore, accounting for just 0.7% of the global market. By 2023, this figure was projected to rise to 1.5%, with the sector more than doubling in value (Mini Tejasvi, 2024). With a player base of over 450 million gamers, including 1.8 million active esports players, India’s online gaming industry was worth INR 33,000 crore in 2023. This is expected to grow to INR 66,000 crore by 2028, at a CAGR of 14.5% (Invest India, 2024).

These trends signal India’s increasing influence in the global digital entertainment landscape and its readiness to lead the next wave of innovation in AVGC-XR.

India’s online gaming population, growing at a CAGR of 10%, is projected to surpass China’s by 2028, exceeding 72 crore gamers. The real money gaming (RMG) sector, which generated INR 16,500 crore in revenue in 2023, is expected to grow at a moderated CAGR of 10% from 2024 to 2028-down from 25% in the previous five years-due to higher GST, reaching INR 26,500 crore by 2028.

India’s online gaming sector is witnessing unprecedented growth, powered by a digitally active young population, affordable mobile data, and a vibrant startup ecosystem. With nearly 600 million people under the age of 35 in 2023–24, the country offers a massive talent pool for game development and consumption (Government of India, 2024).

The proliferation of smartphones-over 650 million users-combined with some of the lowest data costs globally, has accelerated digital entertainment. In 2023, average monthly data consumption reached 24.1 GB per user, marking a 24% increase from 2022 (IAMAI, 2024).

The expanding AVGC (Animation, VFX, Gaming, and Comics) sector has catalyzed innovation and entrepreneurship. Indian gaming startups have collectively secured USD 2.8 billion in investments over the past five years (Invest India, 2024).

In recognition of this sector’s growing significance, the Indian government has approved the establishment of a National Centre of Excellence (NCoE) for AVGC-XR in Mumbai. This center will offer advanced training, interdisciplinary research, and incubation support for startups focused on developing gaming IP rooted in India’s cultural legacy (Dutta, 2024). Additionally, Regional Centres of Excellence (RCoEs) will be set up in collaboration with state governments, academic institutions, and studios to strengthen AVGC education and skilling (Government of Telangana, 2016).

With rural India also becoming a key driver of future growth, the online gaming industry stands at the cusp of becoming one of the leading pillars of India’s creative economy (Free Press Journal, 2024).

Augmented Reality (AR) is reshaping India’s gaming ecosystem-especially among urban youth-by blending digital content with real-world environments. This localized experience enhances engagement and builds deeper cultural resonance among players (Government of Karnataka, 2024).

Blockchain technology is also advancing gaming security and compliance by enabling verifiable, reusable KYC systems. Through tamper-proof digital identities across platforms, it reduces verification redundancies, cuts operational costs, and strengthens trust while maintaining regulatory alignment (Government of Karnataka, 2024).

Virtual Reality (VR) is steadily gaining popularity as more affordable headsets enter the market, allowing users to experience rich, immersive digital environments with greater accessibility (Government of Karnataka, 2024).

1. Game development and design

Collaborative game design through Web 3.0 platforms such as decentralised autonomous organisations (DAOs) Personalised gaming experiences like dynamic storyline based on actions of players with GenAl

2. Publishing

Smart contracts on blockchain to manage IP, licensing rights and royalties transparently Raise funds by offering early access tokens to investors, granting special in-game privileges and returns.

3. Distribution and platforms

Distribute games via Web 3.0 platforms, bypassing traditional app stores and associated costs Self-sovereign digital identities to maintain control over their data and gaming history across platforms

4. Support and infrastructure

Automate customer support processes like refunds, licence renewals, or in-game content ownership disputes using smart contracts Al-driven chatbots and virtual assistants to provide personalised support, addressing issues faced by players in real-time.

5. Community and user engagement

Token economics that give access to exclusive in-game content, rewards and early updates, fostering community loyalty Host concerts, gaming tournaments or fan meetups to deliver immersive experiences with AR/VR/MR

6. Monetisation and revenue generation

Complete tasks or missions within the game to earn digital assets which can be traded or sold in secondary markets Brands can buy ad space within the metaverse, offering immersive, non-intrusive marketing experiences

According to PwC estimates based on insights from industry experts, the gaming sector is becoming a vital contributor to India’s vision of Viksit Bharat, the government’s mission to achieve developed nation status by 2047. With its focus on digital growth, employment generation, and cultural influence, gaming is uniquely positioned to fuel both economic and social transformation.

The industry is projected to generate approximately 2 lakh jobs by FY 2024, with the potential to add another 2-3 lakh positions in the years ahead. The most significant value creation-nearly 85%-comes from specialised roles such as game developers, designers, producers, animators, AI and Web 3.0 specialists, as well as sound engineers, level designers, quality assurance testers, and experts in Game-AI and Gen-AI. These are supported by equally important functions in software engineering, marketing, finance, HR, and administration.

The broader ecosystem offers strong entrepreneurial opportunities. Independent studios, freelancers, and service providers can generate income by designing and selling in-game assets, hosting e-sports tournaments, coaching players, or offering mental and physical wellness services tailored for gamers. This dynamic industry not only supports high-skill employment but also promotes innovation, digital literacy, and India’s cultural expression-making it a powerful engine for national growth.

Beyond core gaming and development, the ecosystem offers diverse income opportunities. Independent studios and freelancers can design in-game assets-both consumable and non-consumable-to boost user engagement. Additional avenues include organizing e-sports tournaments, training professional players, and offering holistic mental and physical health support for gamers.

Gaming and e-sports also foster key cognitive and emotional skills that players acquire naturally through gameplay:

Moreover, gaming’s intersection with technology makes it a strong platform to skill individuals for emerging roles across sectors

The gaming sector in India has emerged as a powerful engine for entrepreneurship and economic growth. Since FY21, the ecosystem has seen the rise of three unicorns, multiple strategic exits with valuations over USD 750 million, and even a successful IPO. With over 1,700 gaming start-ups now active, this momentum is expected to accelerate in the coming years.

According to the Economic Survey of India 2023–2024 (Government of India, 2024), online gaming was among the top contributors to India’s tech-driven start-up space in 2023, accounting for 4% of all new tech-based ventures. The industry is also opening new avenues for wealth creation. Increased user engagement has made gaming platforms attractive for brand advertisers, driving higher returns on investment through formats like opt-in rewards, interactive ads, and personalised video content. Experts anticipate mobile gaming ad revenues to grow at over 20% annually.

The pandemic period served as a catalyst, with rising digital consumption fueling record revenues and investor interest. During this phase, several gaming start-ups secured large-scale funding, with at least four raising over USD 100 million each.

In India, games have always been more than play-they’ve been reflections of community, culture, and storytelling. From chaturanga (chess) and gyan chauper (snakes and ladders) to kho-kho and kabaddi, our traditional games carried values, spiritual teachings, and local lore, passed down through generations and across borders.

Today, as over 40% of the global population engages with gaming, India has the chance to extend this legacy. With technologies like AR, VR, and AI, digital platforms can now take global audiences through immersive journeys-whether it’s exploring the Buddhist circuit or reliving epics like the Ramayana.

We’re already seeing momentum. Games like Shri Ram Mandir, Kurukshetra: Ascension, and Unsung Empires: The Cholas are gaining traction, not only in India but also in countries like Indonesia, Thailand, and even Brazil and Mexico-regions with cultural or historical connections to India.

Gaming is also merging with global pop culture-blurring lines between e-sports, music, cinema, and celebrity. This convergence presents an opportunity: to use games as tools for cultural dialogue, interfaith understanding, and global soft power.

As Dia Rekhi notes in Economic Times (2024), Indian mythology is increasingly taking center stage on gaming platforms. This growing trend isn’t just entertainment-it’s cultural storytelling in motion Gaming could well be India’s next big export-where creativity meets code, and heritage finds a new home on the global stage.

Intellectual Property (IP) lies at the heart of global success in gaming and e-sports. Original IP not only boosts brand identity and loyalty but also drives revenue and market resilience. A strong example of this is NODWIN Gaming-one of India’s leading e-sports and gaming firms-whose portfolio includes over 50 unique IPs. Among them, tournaments like the BGMI series and Playground have garnered massive viewership, with the latter drawing over 25 million unique viewers across platforms.

By expanding to new regions such as Africa, Central Asia, and Turkey, companies like NODWIN are taking Indian gaming IPs global. While most Indian players still gravitate toward internationally-developed games, the appetite for homegrown content rooted in Indian culture is steadily growing-offering an unmatched opportunity for developers to build distinctive, culturally resonant IPs. In a dynamic sector prone to regulatory shifts, IPs also offer business continuity. NODWIN, for instance, acquired nearly 55 million users in 2023 despite regulatory headwinds-underscoring the power of strong IPs in driving user loyalty and engagement.

Collaborations are playing a vital role in building this IP-driven ecosystem. Vi has partnered with global e-sports giant Team Vitality to bolster India’s e-sports infrastructure, focusing on large-scale, original experiences (Financial Express, 2024). Meanwhile, NODWIN Gaming has joined forces with JSW Sports to commercialize and expand Indian gaming IPs both domestically and internationally (Financial Express, 2024).

The time is ripe for India to invest in its own narrative through gaming-turning culture into content and creativity into global IP.

The survey conducted by PwC (2024)- “From Sunrise to Sunshine: The Contribution of Online Gaming to the Viksit Bharat Journey and India’s Cultural Power”-engaged 1,134 urban consumers (primarily working professionals aged 21-40) across major Indian metros. It aimed to understand their gaming behavior, preferences, and the evolving role of gaming in their lives. The findings provide insight into how gaming is becoming mainstream, emotionally engaging, and increasingly responsible in India’s urban landscape.

In the context of Viksit Bharat 2047, India must invest in future-focused ecosystems where creativity meets emerging technologies like AI, Web 3.0, immersive media, and digital storytelling. One such critical domain is gaming.

No longer just entertainment, gaming is a powerful economic and cultural force. With over 2 lakh new jobs projected by FY 2024 and more to come, the industry thrives on high-value roles-game developers, designers, animators, AI experts, Web 3.0 specialists, sound engineers, and data analysts. Nearly 85% of its value lies in these deep tech-creative integrations.

Beyond jobs, gaming drives micro-economies-through esports, digital asset creation, freelance gigs, and wellness services. The opportunity is massive, but it must be steered with foresight and responsibility.

What needs to be done: